Questions from Doctors, Answers for Doctors

The volatility of today’s economy is making retirement an even more important issue to the physicians that I meet. In a recent conversation with a practice owner, the following question was brought to my attention, “Calvin, I am maximizing my current qualified retirement plan, however I would like to put addition dollars away in a similar tax friendly manor . Do I have any options and if so, do all my employee’s have to participate?” The answer to this question is multifaceted.

In today’s increasingly competitive environment, it is getting harder for practices to find an executive benefit plan to attract, retain and reward talented executives. Qualified plans have preferential tax treatment, but employers must include all employees and reward everyone to the same degree, regardless of the benefit they bring to their company . Non-qualified plans are easier to administer and allow employers to reward key employees in a discriminatory fashion. However, they still require plan documents, ongoing administration, and face new regulation from Section 409A of the tax code. What type of plan is available that will reward the most productive employees in a way that is flexible, cost effective, and simple to administer?

My solution for your unique situation is, the Executive Bonus Plan. This plan is appealing to key employees, tax deductible to employers and simple to implement and administer.

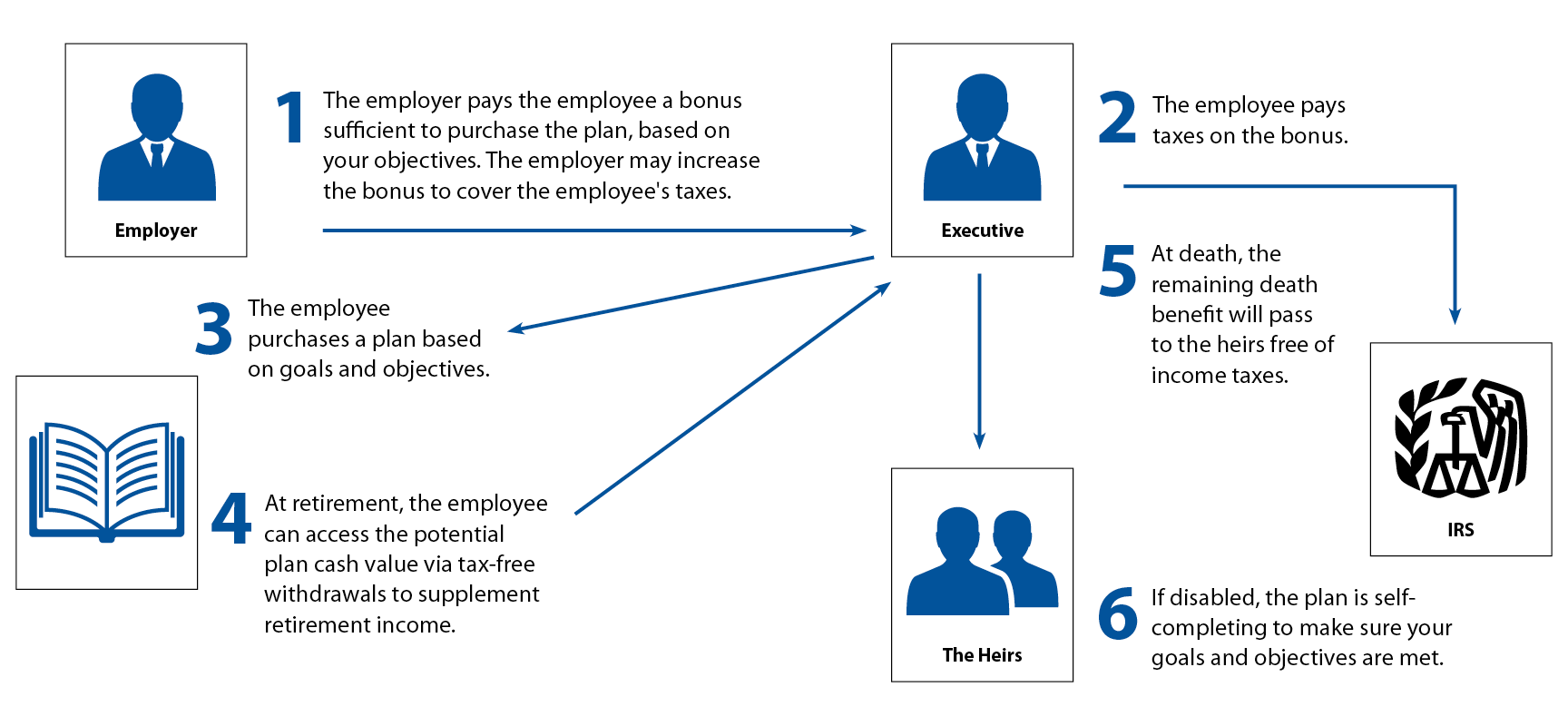

An Executive Bonus Plan (also known as a “162 Bonus Plan) is an arrangement in which the employer pays a bonus to a key executive by paying the annual premium on a life insurance policy for the executive.

The executive will be the owner of the policy and have the right to name the beneficiaries of the policy. The executive will also own any potential cash value and be able to access it at retirement via tax-favored loans and/or withdrawals.

For the employer, the Executive Bonus Plan, provides a tax deductible, discriminatory benefit plan that is simple to implement and inexpensive to administer. The Executive Bonus Plan offers an immediate income -tax deduction of the full bonus amount.

For the executive, the plan offers affordable asset protection and potential supplemental retirement income.

For more information on the concept or to explore other asset protection, tax reduction or wealth management ideas, please feel free to give me a call. When your patients need advise they call you because of your specialty, doesn’t it make sense when you need advise to call someone that specializes in you? Physicians Financial Services has been advising the medical community for over 20 years, if you have questions we have answers.

Calvin R. Rasey is president of Physicians Financial Services II, LLC.

Securities Offered Through Securities America , INC.*Member NASD/SIPC-Calvin R. Rasey-Registered Representative Advisory Services offered through Securities America Advisors, INC.·A registered Investment Advisor-Calvin R. Rasey-Investment Advisor Representative Physicians Financial Services II, LLC and Securities America, INC are NOT UNDER Common Ownership